All Categories

Featured

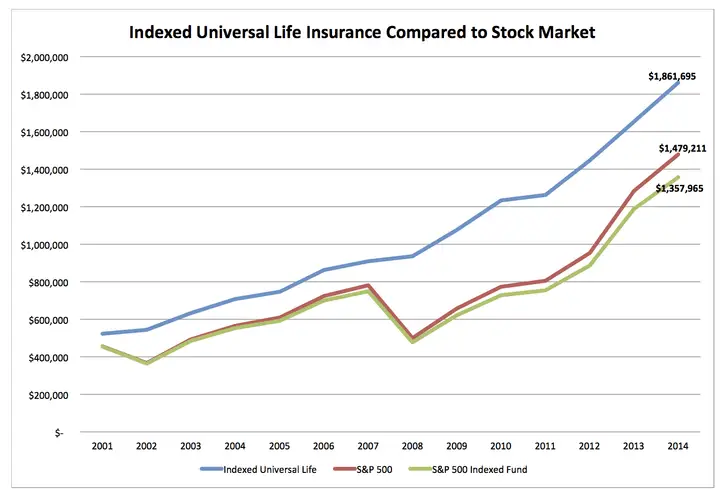

If you're going to use a small-cap index like the Russell 2000, you might want to pause and take into consideration why a great index fund firm, like Lead, doesn't have any funds that follow it. The reason is due to the fact that it's a poor index. And also that transforming your entire policy from one index to another is hardly what I would call "rebalancing - pros and cons of iul." Money value life insurance policy isn't an appealing asset class.

I haven't even addressed the straw guy below yet, and that is the truth that it is fairly rare that you actually have to pay either tax obligations or significant payments to rebalance anyhow. Most smart capitalists rebalance as much as possible in their tax-protected accounts.

Accumulation At Interest Option

Decumulators can do it by taking out from asset classes that have succeeded. And of program, no one needs to be acquiring packed shared funds, ever before. Well, I really hope posts like these help you to translucent the sales strategies usually used by "economic specialists." It's actually regrettable that IULs don't function.

Latest Posts

Allianz Iul

Iul L

Universal Life Calculator